Welcome back to LNG4U — your insider look at the forces shaping the LNG market.

We lead with a crisp insight to keep you out front 🎓, then cut straight to the key stories, from price shifts 💰 to offshore moves that matter 🚢. Let’s dive in.

🎓 LNGKnowledge

How to liquify the Natural Gas and lower its temperature to -1️⃣6️⃣0️⃣ °C ❓

To lower the temperature of the Methane gas to its atmospheric boiling point, there are three 3️⃣ basic liquefaction processes in current use :

1️⃣ Pure Refrigerant Cascade process - In order to reach the low temperature required, three 3️⃣ stages are involved, each having its 👉 own refrigerant, #compressor and #hear exchangers. The first cooling stage utilises #propane, the second stage utilising #ethylene and, finally, a sub-cooling stage utilising #methane is involved.

The cascade process is used in plants commissioned before 1970.

2️⃣ Mixed Refrigerant process - Whereas with pure refrigerant process (as described above) a series of 👉 separate cycles are involved, with the mixed refrigerant process (usually methane, ethane, propane and nitrogen), the entire process is achieved in one 🥇 cycle.

The equipment is less complex 💡 than the pure refrigerant cascade process but power consumption is substantially greater and for this reason its use is not widespread.

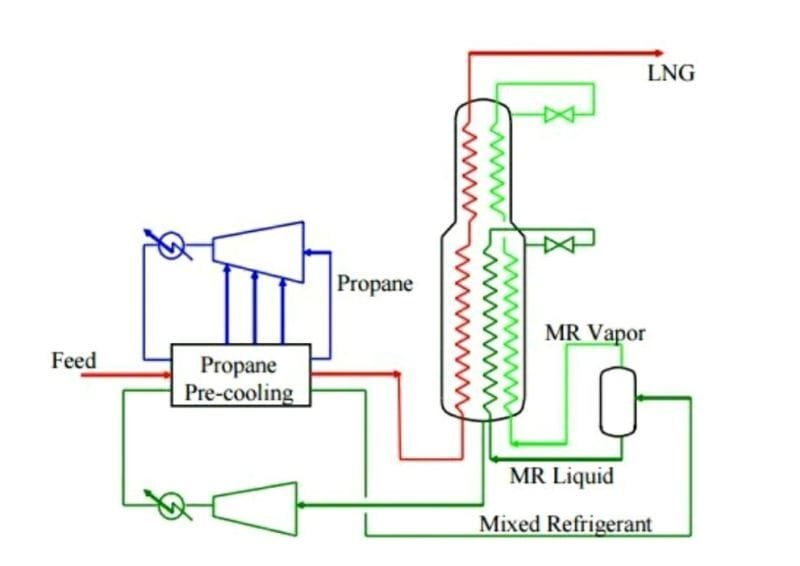

3️⃣ Pre-cooled Mixed Refrigerant process - this process is generally known as the MCR process 👉 Multi-Component Refrigerant and is a combination of the pure refrigerant cascade and mixed refrigerant cycles.

It is by far the most common process in use today.

Source : Oil-gasportal

💰 LNGPrices

Freight rates / 174,000 m3 / 2 Stroke

Atlantic - (Spark30S) | $ 33,750 / day |

Pacific - (Spark25S) | $ 37,250 / day |

Natural Gas

Asia (JKM) - Sep 25 | $ 11.561 / mmBtu |

Europe (NWM) - Sep 25 | $ 10.818 / mmBtu |

Bunkers

$/MT | LNG | VLSFO | MGO |

Singapore | 731.17 | 518.00 | 693.50 |

Rotterdam | 703.92 | 508.00 | 721.00 |

🏭 LNGTerminals

Qatar threatened to cut liquefied natural gas (LNG) supplies ❌ to the European Union (EU) in the wake of the bloc’s new sustainability law 📝

The new law, Corporate Sustainability Due Diligence Directive (CSDDD), calls for large European companies and non-EU players with a strong presence on the continent to “address adverse human rights and environmental impacts” 🎯 throughout their global operations.

(C) Copyright Offshore Energy 2025

Source: Qatar Energy

US producer and shipowner Venture Global has taken a final investment decision 🤝 to build the first phase of what will be the company’s third 3️⃣ LNG production project in Louisiana on the Gulf Coast.

The project approval comes as the European Union agrees to buy 💰750bn worth of US energy products over three years as part of its tariff trade deal negotiated with US President Donald Trump’s administration, a move that boosted stocks of liquefaction developers 📈 including Venture Global on Monday.

(C) Copyright Tradewinds 2025

Source: Venture Global

The Middle East will overtake Asia in natural gas production in 2025 🚀, becoming the world’s second largest producing region behind North America.

This change is being driven by rising output 📈, low breakeven prices 📉, and growing LNG export and import activity across the region 🏭.

Gas production in the Middle East will reach 700 billion cubic metres (bcm) in 2025 💧, outpacing Asia’s expected 620 bcm.

Breakeven gas prices in the Middle East are estimated to be around US$1 to US$2 per million British thermal units (MMBtu), lower 📉 than in other regions.

(C) Copyright Riviera Maritime Media 2025

Source: Oman LNG

🚢 LNGShips

Malaysian shipowner MISC has put two 2️⃣ of its elderly, steam turbine-driven LNG carriers up for sale 💵 joining other who are also trying to shed some of their smaller and least efficient tonnage.

The company has invited initial offers on the 130,405-cbm 1️⃣ Puteri Delima and 2️⃣ Puteri Nilam (both built 1995).

(C) Copyright Tradewinds 2025

Source: MISC

It’s official: Adnoc L&S sales tip 2025 into record books for LNG carrier demolition 🏗

Two steam turbine LNG carriers controlled by Adnoc Logistics & Services have finally been sold for recycling 🏗, turning 2025 into the year boasting the highest number of demolition sales for this ship sector 🚀.

Brokers and cash buyers report that the 137,500-cbm 1️⃣ Ghasha (built 1995) and the 2️⃣ Al Khaznah (built 1994) have been sold for recycling fetching over 💰20m each.

The LNG carrier demolition market has shifted into high gear in 2025 🚀, with a record number of vessels sold for recycling—underscoring a sector-wide pivot away from ageing steam turbine tonnage 🌪 amid a period of low spot rates.

Both ships, featuring Moss-type containment systems rich in non-ferrous metals such as aluminium 🔵, reportedly secured $615 per let—a high price attributed to their scrap metal composition and onboard bunkers 🛢.

(C) Copyright Tradewinds 2025

Source: Sitakunda Ship Breaking

🏗 LNGShipbuilding

The naming ceremony of AL MAS’HABIYYAH built by Hudong Zhonghua Shipbuilding 🏗 for COSCO SHIPPING and China Merchants. The ship will be operated by China LNG Shipping (International) Co Ltd.

This vessel is equipped with GTT - Technology for a Sustainable World ‘s NO96 L03+ membrane system 🏢, combining robust safety, operational efficiency and long‑term performance to advance the energy transition at sea.

(C) Copyright Adnana Ezzarhouni 2025

Source: Adnana Ezzarhouni

Poland’s gas transmission system operator (TSO), Gaz-System, has confirmed a steel-cutting ceremony 🎊, held in South Korea, for the country’s floating storage and regasification unit (FSRU) 🚢, which will be part of a liquefied natural gas (LNG) terminal located in the Gulf of Gdańsk 📍.

White Eagle Energy, a subsidiary of Mitsui O.S.K. Lines (MOL), with which Gaz-System signed a charter agreement 🤝 in April 2024, is responsible for the delivery of the FSRU.

(C) Copyright Offshore Energy 2025

Source: Gaz-System

Nakilat has secured financing with the Export-Import Bank of Korea (Kexim) 🤝 for 25 LNG newbuildings on order at shipyards in South Korea 🚢.

The financing package represented a pivotal step in its long-term strategy to expand its fleet with “cutting-edge” LNG carriers 📈.

(C) Copyright Tradewinds 2025

Source: NYK

🤝 LNGContracts

Italy's Saipem is confident that a 💰20-billion liquefied natural gas project in Mozambique 📍 for TotalEnergies will restart by the end of the summer 📅.

Covered by force majeure since 2021 following insurgent attacks 🚀, the Mozambique LNG project includes developing the Golfinho and Atum natural gas fields in the Offshore Area 1 concession and building a two-train liquefaction plant 💧.

The contract for Saipem is worth around 💰3.5 billion.

(C) Copyright Reuters 2025

Source: Total

💧 LNGBunkering

CMA CGM is teaming up with compatriot energy giant TotalEnergies 🤝 for what it calls a groundbreaking LNG bunkering project 💧.

The alliance will be the first time a boxship operator has collaborated with an oil major 🥇 to jointly operate gas refuelling facilities.

(C) Copyright TradeWinds 2025

Source: CMA CGM

Galveston LNG Bunker Port (GLBP) and Loa Carbon have signed a letter of intent (LoI) 🤝 to supply e-LNG bunkering fuel to ships 💧 calling at the Houston-Galveston port complex on the US Gulf coast.

Scheduled to begin operations in 2028 🎊, the facility is intended to provide LNG fuel to vessels calling at Port Houston, Port of Galveston and Port of Texas City on the US Gulf coast 📍.

(C) Copyright Riviera Maritime Media 2025

Source: Galveston LNG Bunker Port

Steel cutting was carried out for Avenir LNG’s next 20,000cbm 💧 LNG bunkering vessel at Nantong CIMC Sinopacific Offshore & Engineering 🏗.

Hull S1123 is the first of two 2️⃣ vessels and is scheduled for delivery at the end of 2026 🎊, under charter to Vitol International Shipping. The second vessel will follow later this year, with delivery expected early 2027 🎊.

(C) Copyright Avenir LNG 2025

Source: Avenir LNG

🔥 LNGAsFuel

Singapore-based shipowner Eastern Pacific Shipping (EPS) has ordered up to four 4️⃣ LNG-powered Suezmax tankers at Hengli Heavy Industry in China 📍.

The order comprises two firm and two optional 158,000 dwt vessels, priced at 💰90 million each, totalling 💰360 million if all options are exercised.

The tankers, scheduled for delivery in 2028, will be equipped with dual-fuel propulsion systems 🔥, enabling them to operate on LNG fuel 💧.

(C) Copyright Offshore Energy 2025

Source: Bound4blue

LNG is at the forefront of Greek shipowners’ cautious transition toward alternative fuels 🏆, dominating both the active fleet and the orderbook, while methanol is also gaining a notable share 📈.

Approximately 8% of the total Greek-owned fleet (in dwt terms) is capable of burning alternative fuels 🔥. Nearly 80% of this alternative-fuel-capable tonnage is LNG-capable or LNG-ready 💧, with the remaining vessels equipped for methanol, LPG, or ammonia.

(C) Copyright Riviera Maritime Media 2025

Source: Africa Energy Insights

MSC Mediterranean Shipping Company has signed contracts 🤝 for the construction of up to twelve 1️⃣2️⃣ liquefied natural gas (LNG) dual-fuel and LNG-capable containerships 🔥.

MSC has placed an order for four 22,000 TEU boxships at Shanghai Waigaoqiao in China 🤝. The value of the contract has not been disclosed. The units are slated for delivery in 2028 🎊.

MSC has exercised options to build two 22,000 TEU container vessels at Hengli Heavy Industries in China for 💰200 million each. The LNG dual-fuel ships are expected to be delivered between 2028 and 2029 🎊.

The Swiss company has also booked 3+3 LNG-capable 21,000 TEU boxships at China Merchants Heavy Industry (CMHI) Haimen in China. The contract has a price tag of 💰210 million apiece and the ships are planned to be handed over to MSC in 2028 and 2029 🎊.

(C) Copyright Offshore Energy 2025

Source: MSC

⚡ AlternativeFuels

Tsuneishi Heavy Industries (THI), a Philippines-headquartered manufacturing base of Japan’s shipbuilding major Tsuneishi Shipbuilding, has launched what it claims is “the world’s first” 🥇 methanol dual-fuel Kamsarmax bulk carrier.

By running on methanol, the bulker is expected to significantly cut down on its emissions, slashing carbon dioxide (CO2) by 10% and sulfur oxides (SOx) by 99% 📉 compared to conventional ship types.

(C) Copyright Offshore Energy 2025

Source : Tsuneishi Shipbuilding

👨💻 LNGJobs

Faststream Recruitment Group is looking for :

🎯 2nd Officer

🎯 2nd Engineer

🎯 3rd Engineer

Contract

4/3 month tours

Performance bonus

Company share scheme

Requirements

Valid license + valid STCW documentation

12/18 months sea time in rank on LNG tankers

Availability to join ASAP

Have a great week ahead !

Mustapha 👋🏻

Read Next

Did You like this LNG4U Edition ?

If YES, please share it with your friends in Social Media to grow our LNGiers community

📺 LNGAds

Want to advertise in LNG4U? → Send your request to [email protected] 🤝