Welcome back to LNG4U — your close-up look at the changes defining LNG market.

We kick things off with an insight to keep you thinking ahead 🎓, then break down the moves that are really driving momentum — from price action 💰 to offshore developments 🚢.

Here’s what’s happening now.

🎓 LNGKnowledge

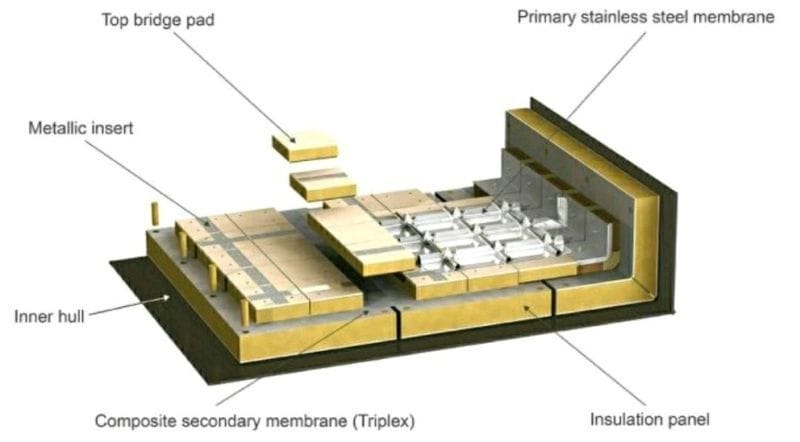

Despite the LNG very low temperature -160°C inside the cargo tanks versus the high ambient temperature outside +30°C, the LNG ship's cargo tanks' insulation plays a vital role 🎯 to keep the boil-off gas to minimum 📉.

The boil-off gas rate in the recent cargo containment is about 0,07% per day 🎯 of the total volume. A cargo of 170K m³ LNG has a BOG 💭 of 119 m³ per day ONLY !

Source : GTT

💰 LNGPrices

Freight rates / 174,000 m3 / 2 Stroke

Atlantic - (Spark30S) | $ 130,750 / day |

Pacific - (Spark25S) | $ 78,750 / day |

Natural Gas

Asia (JKM) - Jan 26 | $ 11.089 / mmBtu |

Europe (NWM) - Jan 26 | $ 9.641 / mmBtu |

Bunkers

$/MT | LNG | VLSFO | MGO |

Singapore | 680.62 | 442.00 | 698.00 |

Rotterdam | 650.20 | 411.50 | 695.50 |

🏭 LNGTerminals

On November 18, the FSRU Höegh Gannet was berthed alongside its sister ship, the Höegh Esperanza 🚢, for a brief period, at the LNG Terminal Wilhelmshaven 1.

The Höegh Gannet was loaded with approximately 40,000 cubic meters of LNG 💧 from the Höegh Esperanza to prepare for its return to Brunsbüttel 🏭.

Previously, the Höegh Gannet had completed technical work at the Fayard shipyard in Denmark 🏗 and is scheduled to resume operations at the Elbehafen Brunsbüttel at the end of November.

(C) Copyright DET 2025

Source: DET

LNG producer and shipowner Venture Global has filed its applications to build the expansion phase 🏭 of its Plaquemines project in the US at almost 40% larger than originally planned 📈.

The company filed for permitting and approval with the Federal Energy Regulatory Commission and the Department of Energy for export authorisations on what will be a 30-mtpa 💧 brownfield expansion phase.

It will be built in three phases, consisting of 32 modular liquefaction trains 🏭.

(C) Copyright Tradewinds 2025

Source: Venture Global

China imported a record 1.299 million metric tons of Russian liquefied natural gas (LNG) 💧 in September.

That total marked a roughly 73% increase 📈 from September 2024, when imports reached 751,000 tons.

The surge reflects Russia’s broader shift toward Asian markets after Europe drastically reduced its reliance on Russian gas following the full-scale invasion of Ukraine 🚀.

(C) Copyright The Moscow Times 2025

Source: Novatek

The LNG market are set to move through a period of rapid expansion into one of disciplined growth 📈 over the next 20 years, with a greater range of complexities, according to Poten & Partners.

North America leads the forecast growth, with an additional 212.6 mpta of LNG supply 💧 coming onstream by 2030, which will almost double current volumes.

The market for LNG looks set to remain long into the late 2020s, pushing up the risk of oversupply and cargo cancellations 🚫 during the 2027 to 2030 period.

(C) Copyright TradeWinds 2025

Source: Port of Rotterdam

ExxonMobil has lifted force majeure 🔵 on a large liquefied natural gas project in Mozambique called Rovuma LNG.

The company paused work after French oil major TotalEnergies also declared force majeure 🚨 on its separate LNG project in 2021 due to security concerns in the southern African country. ExxonMobil and TotalEnergies' projects share some facilities.

The U.S. oil firm continues to expect to make a final investment decision 💵 on the project in 2026, with first LNG targeted for 2030.

(C) Copyright Reuters 2025

Source: CAMILLE LAFFONT/AFP

Egypt has agreed to purchase approximately 8️⃣0️⃣ shipments of liquefied natural gas from the American company "Hartree Partners" for a value of 💰4 billion dollars, with shipments set to begin in January

Egypt transitioned to being a major importer in 2024 due to declining production from local fields 📉 and increased demand resulting from population growth and rising temperatures 📈, putting pressure on global markets.

(C) Copyright Sada News 2025

Source: Energos Infrastructure

🚢 LNGShips

Norwegian shipowner Awilco LNG is searching for longer-term employment 🎯 for its two tri-fuel diesel-electric LNG carriers after taking redelivery of them from time-charter contracts 📘.

The 156,000-cbm WilPride (built 2013) was redelivered in November and is now trading in the spot market 🌎 along with sister ship WilForce (built 2013).

Both vessels are fixed on short-term employment covering most of the available days in 2025 📅 while it searches for longer-term employment.

(C) Copyright Tradewinds 2025

Source: Awilco LNG

Increased production of LNG in West Africa and the United States 📈, and delays in discharges at Egyptian LNG terminals 🕔, has prompted a short squeeze on LNG shipping availability 📉. Rates have increased dramatically over the past three weeks 🚀.

LNG freight was being offered at 💰170,000 per day on the follow in the London market on the morning of November 21. This represents a 150 percent rise 🚀 in rates in comparison with the Atlantic $75,000 per day rate being quoted two weeks ago.

Some LNG importers in the United States are delaying purchases 🔴 in the hope that the spike in shipping rates will fall away.

(C) Copyright Maritime Executive 2025

Source: Wilhelmsen

A Russian shadow fleet LNG carrier is shipping a cargo from the country’s sanctioned Arctic LNG 2 project 🏭 into its west-based giant floating storage unit.

The Arc4 174,000-cbm LNG carrier Buran (ex-North Air, built 2023) has arrived at the 361,000-cbm Saam FSU (built 2023) in Ura-Guba to the north-west of Murmansk.

(C) Copyright Tradewinds 2025

Source: Rosmorport

🏗 LNGShipbuilding

West African producer Nigeria LNG (NLNG)’s shipping arm has selected its preferred shipbuilder 🤝 for a batch of up to six upcoming LNG carrier newbuildings 6️⃣ as it moves to renew its fleet.

Bonny Gas Transport (BGT) has homed in on China’s Hudong-Zhonghua Shipbuilding 🤝 to build three LNG carriers and lined up slots for an optional trio of vessels.

(C) Copyright Tradewinds 2025

Source: Flickr

Five shipowners are battling it out to build a series of LNG carrier newbuildings 🚢 for Norwegian energy company Equinor.

Those following the business listed the companies as 👉 BW LNG, Knutsen OAS Shipping, Maran Gas Maritime, NYK and Seapeak.

Equinor has selected South Korean shipbuilder Hanwha Ocean to build up to four LNG carriers 🏗.

(C) Copyright Tradewinds 2025

Source: Hanwha Ocean

Seaspan Corp is breaking into the gas sector with an order for up to six 6️⃣ 100,000-cbm very large ethane carrier newbuildings at Jiangnan Shipyard in China 🏗.

State-owned China State Shipbuilding Corp (CSSC) revealed that a memorandum of cooperation for three ships has been signed 🤝 with Seaspan, Cosco Shipping LNG, CSSC Trading and Jiangnan Shipyard at the Maritime Forum in Hong Kong.

(C) Copyright Tradewinds 2025

Source: Jiangnan Shipyard

BW LNG is being named as the owner behind an order of two 2️⃣ LNG carrier newbuildings at HD Hyundai.

HD Korea Shipbuilding & Offshore Engineering (HD KSOE) said it had signed a 💰507m contract with a company based in North America.

The vessels will be constructed by HD Hyundai Samho and are scheduled for delivery in 2028 🎊.

(C) Copyright Tradewinds 2025

Source: BW LNG

COSCO Shipping celebrated the naming ceremony of the 7th ship in a series of 8, the LNG carrier Qingcheng, built by Hudong Zhonghua Shipbuilding for PetroChina International 🎊.

The vessel features GTT - Technology for a Sustainable World NO96 L03+ technology 🏢 and is classed by Lloyd's Register 🖋.

(C) Copyright Adnan Ezzarhouni 2025

Source: Adnan Ezzarhouni

🤝 LNGContracts

Saudi Aramco has announced a series of 17 memoranda of understanding (MoUs) and agreements with U.S. companies 🤝, potentially valued at more than 💰30 billion.

Aramco signed an MoU with MidOcean Energy for potential investment in the Lake Charles LNG project 🏭 on the U.S. Gulf Coast.

Additionally, it is exploring cooperation with Commonwealth LNG on a liquefaction project in Louisiana, which could involve LNG and gas purchases 💵 by Aramco Trading.

(C) Copyright Energy News Beat 2025

Source: Bander Alfowzan

Russian liquefied natural gas producer Novatek has slashed the prices of its cargoes by 30% to 40% 📉 since August to entice Chinese buyers to purchase sanctioned gas from its Arctic LNG 2 project at Deep Discounts 💵.

The gas producer sold its first cargo, which was delivered on August 28, at a discount of $3 to $4 📉 to the Asian benchmark LNG price of around $11 per mmBtu.

(C) Copyright Reuters 2025

Source: USM

🔥 LNGAsFuel

HD Korea Shipbuilding & Offshore Engineering (HD KSOE) has inked a ‘major’ 💰1.46 billion contract with compatriot maritime transport company HMM for eight 8️⃣ 13,400 TEU dual-fuel boxships.

The vessels are to be delivered fitted with dual-fuel engines powered by liquefied natural gas (LNG) 💧 and an enlarged fuel tank (reportedly expanded by approximately 50%). This is expected to improve the ships’ operational efficiency 📈.

(C) Copyright Offshore Energy 2025

Source: HD Hyundai

MISC has inked shipbuilding contracts 🤝 with an undisclosed shipyard for two LNG-dual fuel Suezmax tankers

The newbuilds will be operated by petroleum and product tanker arm AET 🏢 and on long-term time charters to an unnamed party.

The Malaysian shipowner has a fleet of 106 vessels with 21 newbuildings 🚢 set to enter the fleet over the next two – three years.

(C) Copyright Seatrade Maritime 2025

Source: AET

🎬 LNGVideos

LNG carriers, not container ships, will lead the next scrapping wave 📈

Key players within the ship recycling sector are betting that steam-powered LNG carriers will lead the revival 🥇 of their niche sector.

Facing a bleak future, old steam-powered LNG carriers languishing in lay-up are considered prime scrap candidates 🏗.

Source : Eren Topcu

👨💻 LNGJobs

Bernhard Schulte Shipmanagement (BSM) is looking for :

Chief Officer

Chief Engineer

ETO

Gas Engineer

Have a great week ahead !

Mustapha 👋🏻

📺 LNGAds

Want to advertise in LNG4U? → Send your request to [email protected] 🤝

Read Next

Did You like this LNG4U Edition ?

If YES, please share it with your friends in Social Media to grow our LNGiers community