Welcome back to LNG4U — your straight shot to the trends steering the LNG market.

We start with a sharp insight to keep you a step ahead 🎓, then break down the shifts that count — from market moves 💰 to offshore shakeups 🚢.

Let’s get into it.

🎓 LNGKnowledge

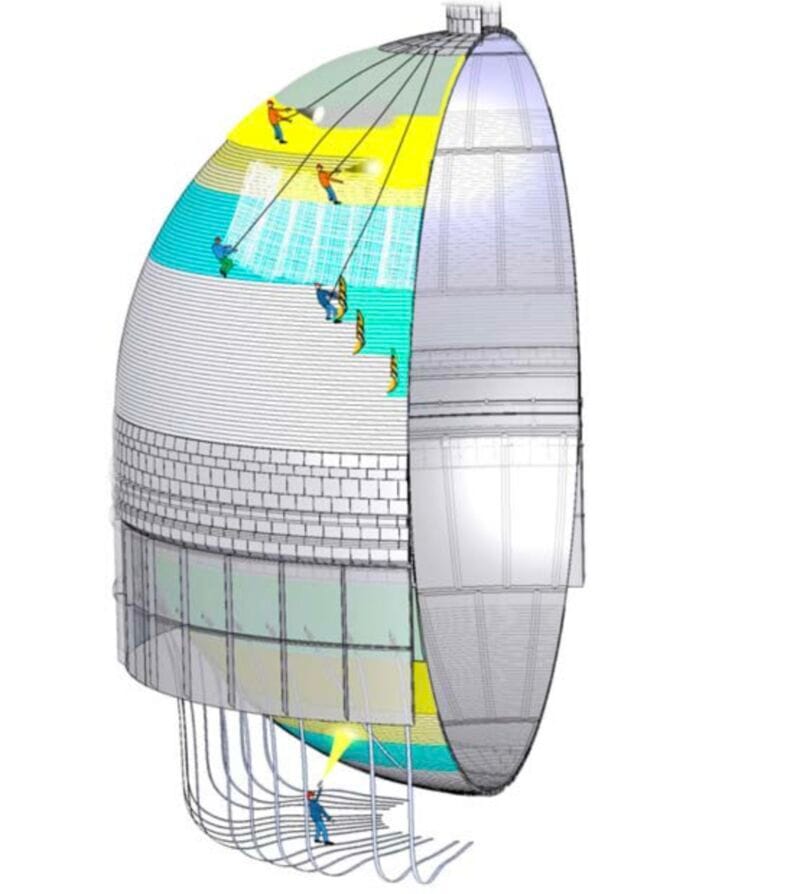

What is the material used for the LNG Moss type cargo containment❓

The cargo containment system consists of insulated independent spherical tanks constructed from aluminium alloy and designed to carry LNG at cryogenic temperatures and at a pressure close to atmospheric pressure.

The tanks are encased within void spaces and situated in-line from forward to aft within the hull. The spaces between the inner hull and outer hull are used for ballast and also provide protection to the cargo tanks in the event of an emergency situation, such as a collision or grounding.

There is no ❌ FULL secondary barrier as the tanks, primarily due to their spherical construction, have a high degree of safety against fracture or failure. The tanks are heavily insulated with approximately 200mm of polystyrene foam to reduce boil-off to a minimum 📉.

Source : LNT Marine

💰 LNGPrices

Freight rates / 174,000 m3 / 2 Stroke

Atlantic - (Spark30S) | $ 35,750 / day |

Pacific - (Spark25S) | $ 33,000 / day |

Natural Gas

Asia (JKM) - Oct 25 | $ 10.928 / mmBtu |

Europe (NWM) - Oct 25 | $ 10.249 / mmBtu |

Bunkers

$/MT | LNG | VLSFO | MGO |

Singapore | 698.25 | 497.50 | 638.50 |

Rotterdam | 680.05 | 471.00 | 650.00 |

🏭 LNGTerminals

Greek gas player Gastrade has resumed operations at the liquefied natural gas (LNG) terminal 🚀 featuring a floating storage and regasification unit (FSRU) it operates in the Aegean Sea 📍.

The Greek player reported the start of unloading and regasification services at the Alexandroupolis LNG terminal on August 11, a few days earlier than originally envisaged.

Regasification services were stopped 🚨 in late January 2025 due to a technical issue leading to the damage of the unit’s booster pump 🛑.

(C) Copyright Offshore Energy 2025

Source: Gastrade

Centrica and Energy Capital Partners are in exclusive talks to buy 🤝 the UK’s largest liquefied natural gas import terminal in a roughly 💰2bn deal from its owner National Grid.

A deal could be announced shortly, handing control of one of Britain’s main strategic energy assets 💡 to one of its largest household energy suppliers.

The Isle of Grain gas import terminal, on the Thames estuary in Kent, is the largest LNG import terminal in Europe with capacity to process 15mn tonnes per year of gas 💭, or about 20 per cent of the UK’s demand.

(C) Copyright FINANCIAL TIMES 2025

Source: VINCI

Centrica Energy has signed a natural gas sale and purchase agreement (SPA) 🤝 with U.S.-based Devon Energy Corporation.

Devon is set to deliver 50,000 million British thermal units (MMBtu) per day of natural gas 💭 – equivalent to five liquefied natural gas (LNG) cargoes per year 💧 – to Centrica under the 10-year deal starting in 2028 📅.

The volumes will be indexed to the European gas hub price (TTF) 💵, providing Devon with international price exposure.

(C) Copyright Offshore Energy 2025

Source: Centrica

The United States has had internal discussions on using Russian nuclear-powered icebreaker vessels 🚢 to support the development of gas and LNG projects in Alaska 🏭.

Russia operates the world's only fleet of nuclear-powered icebreakers ⚡, which play a central role in maintaining year-round shipping access along the Northern Sea Route, a strategic path for global energy and trade flows 🌎.

Trump has pitched Alaska LNG, a proposed 💰44 billion project to ship liquefied natural gas along a 800-mile pipeline from Alaska, to Asian buyers as a way to reduce their dependence on Russian LNG 💧.

(C) Copyright Reuters 2025

Source: Cool Antarctica

🚢 LNGShips

The LNG vessels- 1️⃣ North Moon, 2️⃣ North Ocean, and 3️⃣ North Light- owned and managed by Mitsui OSK Lines Ltd (MOL), Japan’s second largest shipping company were spotted waiting at BATU AMPAR ANCH Indonesia ⚓

The European Union has imposed sanctions on these LNG carriers 🚨 that transported liquefied natural gas from Russia’s Yamal LNG facility to Asia, then delisted them from the sanctions list last month 🎯.

All three ships were built in 2024 and are ice-class Arc4 tankers designed to operate in Arctic waters ❄.

(C) Copyright Mustapha Zehhaf 2025

Source: Mustapha Zehhaf

A group of four 4️⃣ LNG carriers is moving eastbound through the Northern Sea Route, laden with cargoes loaded at Novatek’s sanctioned Arctic LNG 2 plant in Russia 🏭.

The ice-breaking Arc7 vessel, the 172,600-cbm 👉 Christophe de Margerie (built 2017), is leading the pack and moving in the wake of another Arc7, the 172,600-cbm 👉 Vladimir Voronin (built 2019), which is carrying a cargo from the non-sanctioned Yamal LNG.

(C) Copyright TradeWinds 2025

Source: Sovcomflot

🏗 LNGShipbuilding

Venture Global has boosted its owned and operational LNG carrier fleet to four 4️⃣ vessels with the delivery of two 2️⃣ newbuildings and has five more ships inbound.

The company said it took delivery of the 174,000-cbm Venture Acadia and Venture Creole in May and July, respectively.

This brought their total owned fleet of LNG tankers to four 4️⃣ with an additional five 5️⃣ LNG tankers that they have contracted to construct and/or acquire.

(C) Copyright Tradewinds 2025

Source: Venture Global

Seatrium has signed a Letter of Intent (LOI) with Karpowership 🤝, a global energy company and the owner, operator, and builder of the world’s largest Powership (floating power plant) fleet.

The agreement includes the conversion, life extension and repairs of three LNG carriers into floating storage and regasification units (FSRUs) 🚢. This involves the installation of regasification modules, spread-mooring systems, and the integration of critical supporting systems such as cargo handling, offloading, utility, electrical, and automation systems 💧.

Under the LOI, Seatrium will carry out the integration of four New Generation Powerships 🏭, with an option for two additional units. Karpowership will deliver the hulls and key equipment for the four Powerships to Seatrium Singapore, where integration works will begin in the first quarter of 2027 📅.

(C) Copyright MarineLink 2025

Source: Karpowership

Golar LNG is stepping up efforts to secure a yard slot 🤝 and long-lead equipment for what would be its fourth 4️⃣ floating LNG (FLNG) production unit.

Golar is in talks with three shipyards over potential designs and construction schedules 🏗. The designs under consideration-MK I, MK II, and MK III-range in liquefaction capacity from 2.0 to 5.4 million tonnes per annum (mtpa) 💧.

The company is pursuing its fourth unit without waiting for a charter 🚫, a strategy it previously applied to both the FLNG Hilli and the MKII project. Golar said yard capacity constraints 🔴 suggest this could be the only FLNG unit available for delivery within the decade.

(C) Copyright Splash247 2025

Source: Golar LNG

China LNG Shipping (International) Co Ltd celebrated the delivery🎊 of the third LNGC constructed by Hudong Zhonghua Shipbuilding (group) Co., Ltd. 👉 FAT’H AL KHEIR.

This ship is built for the consortium CLNG (a JV between COSCO SHIPPING and China Merchants), NYK Line – "K" line (Kawasaki Kisen Kaisha, Ltd) – MISC Group , 🤝 chartered by QatarEnergy

✅ This LNG carrier features GTT - Technology for a Sustainable World NO96 L03+ containment technology 🏢 and WinGD Ltd. 2.0 engines 🏭.

(C) Copyright Adnan Ezzarhouni 2025

Source: Adnan Ezzarhouni

Adnoc Logistics and Service celebrated the delivery 🎊 of the third LNGC built by Jiangnan Shipyard 👉 Al Reef.

Al Reef is a state-of-the-art LNG carrier, equipped with the latest-generation systems designed to reduce fuel consumption and therefore emissions:

• Cryostar reliquefaction system for optimal boil-off gas management 💭

• Silverstream Technologies air lubrication system to lower hydrodynamic resistance 🌊

• WinGD Ltd. 2.0-generation dual-fuel engine for efficiency and reliability 🏭

GTT - Technology for a Sustainable World Mark III Flex technology 🏢 offers 175,000 m³ capacity – combining performance, sustainability, and innovation.

(C) Copyright Adnan Ezzarhouni 2025

Source: Adnan Ezzarhouni

Greece’s TMS Cardiff Gas and Denmark’s Celsius Shipping have been linked to 💰1.5Bn in new LNG carrier orders in South Korea 🏗

Samsung Heavy Industries announced an order for four 4️⃣ LNG carriers valued at just over US$1Bn

(C) Copyright Riviera Maritime Media 2025

Source: Samsung Heavy Industries

🤝 LNGContracts

Australian energy infrastructure developer Venice Energy has agreed to sell 🤝 its project to LNG terminals and downstream infrastructure firm AG&P LNG.

The agreement means AG&P LNG will provide 100% of project financing 💵 and will construct and operate the terminal. A final investment decision is expected later this year.

The LNG import terminal is located in Outer Harbour in Port Adelaide, South Australia 📍. The project includes an FSRU with a minimum storage of around 145,000 cu m, two new wharfs, loading arms, cryogenic piping, pumps, and associated infrastructure 🏭.

(C) Copyright Splash247 2025

Source: GreenOak

Ocean Yield and KKR-managed vehicles have agreed to acquire CapeOmega Gas Transportation 🤝 from private equity firm Partners Group, expanding their exposure to the LNG sector 📈.

CapeOmega holds joint ownership in a fleet of ten 🔟 174,000 cu m LNG carriers operated by Knutsen. Seven of the ships are already on the water 🌊, averaging two years in age, while the remaining three are slated for delivery between 2025 and 2026 🎊.

All ten vessels are on long-term charters to energy majors Shell, Engie, and QatarEnergy 🤝, with an average firm contract length of nine years. Including optional periods, the average charter duration extends to 16 years 📅.

(C) Copyright Splash247 2025

Source: Knutsen LNG

Hanwha Aerospace has joined forces with Hanwha Energy and Korea Southern Power 🤝 to bolster cooperation in the global liquefied natural gas (LNG) sector 💧 and means of obtaining U.S. LNG to boost Korea’s energy security.

The three companies aim to advance the development of an integrated LNG value chain, marking the start of a new public–private collaboration 📈 to secure competitive LNG procurement and diversify supply sources 🏭.

(C) Copyright Offshore Energy 2025

Source: Hanwha Ocean

Russian President Vladimir Putin signed 🖋 a decree that could allow foreign investors, including top U.S. oil major Exxon Mobil to regain shares 💵 in the Sakhalin-1 oil and gas project.

Exxon previously held a 30% operator share 📊 in the lucrative project, and is the only non-Russian investor to have quit its stake.

The decree stipulates that foreign shareholders must undertake actions to support the lifting of Western sanctions 🚨 if they want to regain their share. They must also conclude contracts for supplies of necessary foreign-made equipment to the project 🏭, and transfer funds to Sakhalin-1 project accounts 💵.

(C) Copyright Reuters 2025

Source: CSE COMSEC

💧 LNGBunkering

Seaspan Energy has formed a strategic partnership 🤝 with Anew Climate to start delivering renewable liquefied natural gas (R-LNG) 💧 on North America’s West Coast.

As part of the partnership, Anew will be in charge of supplying ISCC-certified renewable natural gas (RNG) 💭 and providing pre-audit services to Seaspan required for ISCC certification. The fuel will be compliant with global standard frameworks 🎯 such as the IMO Net-Zero Framework and the FuelEU Maritime Regulation.

(C) Copyright Offshore Energy 2025

Source: Seaspan

First LNG bunkering operation 🥇 of world’s largest cruise ship completed at Port Canaveral 📍.

The LNG bunkering operation was completed by Seaside LNG, which dispatched bunker vessel 👉 Clean Everglades to supply 👉 Star of the Seas with enough fuel to last a few weeks.

(C) Copyright Manifold Times 2025

Source: Seaside LNG

Spanish shipowner Ibaizabal has reportedly expanded its growing LNG bunker vessel orderbook 🤝 with a new ship in China

Hudong-Zhonghua Shipbuilding has secured an order from Ibaizabal for an 18,600-m³ vessel 💧, with delivery scheduled between late 2027 and 2028 🎊.

(C) Copyright Riviera Maritime Media 2025

Source: TotalEnergies

Have a great week ahead !

Mustapha 👋🏻

Read Next

Did You like this LNG4U Edition ?

If YES, please share it with your friends in Social Media to grow our LNGiers community

📺 LNGAds

Want to advertise in LNG4U? → Send your request to [email protected] 🤝