Welcome back to LNG4U — your regular check-in on what’s shaping the LNG market.

We start with a perspective to keep you ahead 🎓, then turn to the developments that deserve your attention — from market signals 💰 to offshore activity 🚢.

Let’s get into it.

🎓 LNGKnowledge

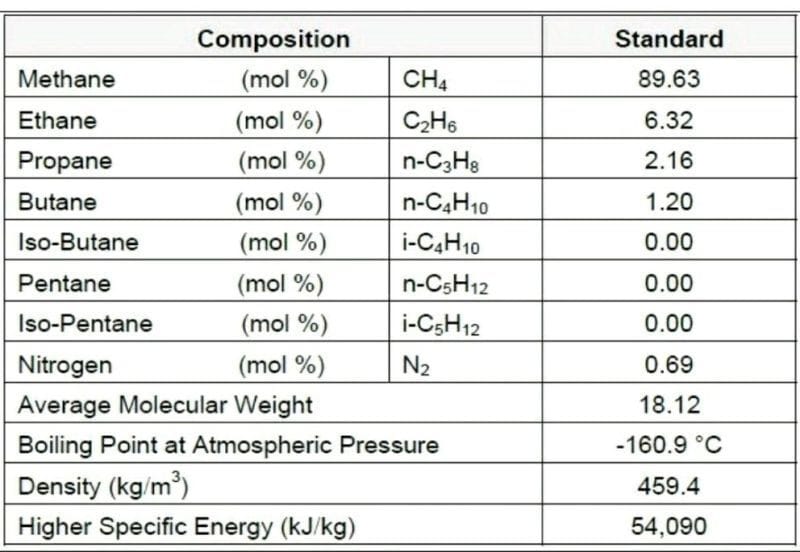

The Natural Gas is mainly methane CH4 and it's not 100 %.

The makeup of the LNG to be handled as loaded 💧is expected to be within the table’s range (Depending on the loading terminal)

Source : LNG Shipping Knowledge

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

💰 LNGPrices

Freight rates / 174,000 m3 / 2 Stroke

Atlantic - (Spark30S) | $ 80,750 / day |

Pacific - (Spark25S) | $ 71,250 / day |

Natural Gas

Asia (JKM) - Feb 25 | $ 9.646 / mmBtu |

Europe (NWM) - Feb 25 | $ 9.232 / mmBtu |

Bunkers

$/MT | LNG | VLSFO | MGO |

Singapore | 621.19 | 426.00 | 602.00 |

Rotterdam | 638.04 | 402.50 | 605.50 |

🏭 LNGTerminals

Russia has pushed back by "several years" 📉 a plan to reach an annual liquefied natural gas output target of 100 million tons 💧.

Russia's long-term plans to gain a fifth of the global LNG market by 2030-2035, from 8% currently, have been challenged by sanctions 🛑 imposed over the conflict in Ukraine, including against the new Arctic LNG 2 plant.

A recently updated government strategy, which outlines Russia's long-term plans in energy sector, sees the country producing 90-105 million tons of LNG by 2030 and 110-130 million tons by 2036 📅.

(C) Copyright Reuters 2025

Source: Yamal LNG

Mistras has been hired for an assignment at a multibillion-dollar liquefied natural gas (LNG) development project in Louisiana, operated by Australia’s Woodside Energy 🤝.

Bechtel has selected Mistras to deliver non-destructive testing (NDT) services for the $17.5 billion Louisiana LNG production and export project 🏭, formerly known as Driftwood LNG, under construction in Louisiana.

(C) Copyright Offshore Energy 2025

Source: Woodside Energy

EIG has acquired a stake from Canada Pension Plan Investment Board 💵 in Transportadora de Gas del Perú S.A. (TGP).

Thanks to this acquisition, the firm has obtained a 49.87% equity stake in TGP 💰, which operates Peru’s principal natural gas and natural gas liquids pipelines under a long-term concession, supplying approximately 40% of the country’s power generation ⚡.

(C) Copyright Offshore Energy 2025

Source: PLNG

Cheniere Energy has tucked a new milestone with the substantial completion of the fourth train 🏭, which is part of its expansion project on the La Quinta Ship Channel, along the north shore of Corpus Christi Bay in Texas, United States 📍.

The substantial completion of Train 4 at its Corpus Christi Liquefaction Stage 3 project (CCL Stage 3) was reached thanks to Bechtel Corporation 🏗, as the project’s engineering, procurement, and construction contractor, which transferred care, custody and control of the train to Cheniere on December 19, 2025 📅.

(C) Copyright Offshore Energy 2025

Source: Cheniere Energy

Freeport LNG reports all three trains at its LNG export plant in Texas experienced a trip 🚨 due to an interruption of feed gas to the facility

The plant operators managed the cooldown and restarts of train 1, train 2, and train 3 📈 as efficiently as possible to minimize flaring

Freeport is one of the most closely watched U.S. LNG export facilities because fluctuations in its operations 📊 have the potential to cause swings in global gas prices.

(C) Copyright Energy Now 2025

Source: Freeport LNG

🚢 LNGShips

Arctic Shipping Lane Sees Surge in ‘Shadow Fleet’ Traffic, Totaling 100 Sanctioned Vessels 🚢

Russia’s Arctic shipping lanes have become a corridor 🌏 for the global shadow fleet of sanctioned oil and LNG tankers.

In 2025 nearly one third of vessels using the route were part of the so-called dark fleet ⚫. A report by the Bellona Foundation identified 100 sanctioned ships, majority oil and gas tankers, using the route over the past year, a dramatic increase over just 13 such vessels in 2024 📈.

(C) Copyright GCAPTAIN 2025

Source: Atomflot

🏗 LNGShipbuilding

NLNG has ordered three new LNG carriers from 🤝 China’s Hudong-Zhonghua Shipbuilding through its shipping arm, Bonny Gas Transport (BGT).

The ships, each with a capacity of 174,000 cubic meters 💧, are part of the company’s fleet renewal and are slated for delivery in 2029.

The contract also includes options for three additional vessels 🏗.

(C) Copyright City Business News 2025

Source: Transport day

Shipowner Purus has been linked to a fresh LNG carrier newbuilding contract with 🤝 Samsung Heavy Industries in South Korea, further expanding its gas carrier portfolio

The order for two LNG carriers valued at approximately 💰502.8M. The pair is scheduled for delivery by the end of Q1 2029 🎊.

Purus oversees a fleet of 19 advanced low-carbon gas carriers 🚢 engaged in the transport of LNG, ammonia, LPG and ethane.

(C) Copyright Riviera Maritime Media 2025

Source: Purus

Russian shipping company Sovcomflot has taken delivery of the much-delayed first ice-class LNG carrier 🚢 built in the country.

The 172,600-cbm Alexey Kosygin has been handed over from the Zvevda Shipbuilding Complex to export gas from the Arctic LNG 2 plant 💧.

The Alexey Kosygin will be followed by two 2️⃣ more ships next year.

(C) Copyright Tradewinds 2025

Source: Zvevda Shipbuilding

Japan’s shipping giant Mitsui O.S.K. Lines (MOL) has struck a finance deal 💵 for a floating storage and regasification unit (FSRU), which will be deployed in Singapore, Asia 🚢.

This deal is for a newbuild floating storage and regasification unit to be operated by 🤝 Singapore LNG Corporation (SLNG) as the second liquefied natural gas (LNG) terminal in Singapore.

The FSRU project is perceived to mark the first 🥇 deployment of an FSRU in Singapore

(C) Copyright Offshore Energy 2025

Source: Hanwha Ocean

Industry leaders report new liquefaction volumes, fleet obsolescence and limited yard capacity driving LNG carrier fundamentals into 2028–2030 🚀.

2028 shipyard availability is “more or less fully booked” 🛑, with ordering now effectively targeting 2029 delivery slots on a roughly three-year lead time.

Older steam turbine vessels lack parcel size and boil-off performance 🚫 in a market dominated by flexible portfolio players.

Newbuilding prices “around the 💰250M range” had already bottomed and were expected to move “north of 💰260” in a tighter market 📈.

(C) Copyright Riviera Maritime Media 2025

Source: ADNOC L&S

🤝 LNGContracts

Petronas has strengthened its position in Asia’s liquefied natural gas market after signing a long-term LNG supply agreement with 🤝 China National Offshore Oil Company (CNOOC), underscoring the continued importance of gas in the region’s energy transition.

Under the sale and purchase agreement, Petronas LNG Ltd. will deliver 1.0 million tonnes per annum (MTPA) of LNG 💧 to CNOOC Gas and Power Singapore Trading & Marketing, extending a partnership that has spanned years of LNG cooperation between the two state-backed energy companies.

(C) Copyright Oil Price 2025

Source: Petronas

BOTAŞ has signed off on a long-term liquefied natural gas (LNG) agreement with 🤝 Australia’s energy giant Woodside, which is expected to further diversify the energy mix and strengthen the security of supply for Türkiye ⚡.

The duo’s sale and purchase agreement (SPA) for the nine-year 9️⃣ supply of LNG will enable Woodside to provide BOTAŞ with a total of approximately 5.8 billion cubic meters natural gas equivalent, or 0.5 million tonnes per annum of LNG 💧, starting in 2030.

(C) Copyright Offshore Energy 2025

Source: Woodside Energy

Hyundai LNG Shipping deal faces pushback amid sale 🤝 to Indonesian firm

Residents of Busan reportedly protested against private equity firm IMM’s plan 🚨 to sell Hyundai LNG Shipping to Indonesia’s Sinar Mas.

Protesters argued If a foreign buyer replaces skilled, high-paid Korean crews with foreign workers to cut costs, Busan’s job market could collapse 📉.

(C) Copyright Manifold times 2025

Source: Hyundai LNG Shipping

💧 LNGBunkering

Somtrans 8,000-m³ LNG bunker barge to start work in ARA in 2026 🎊

The vessel as intended for inland waterway service and estuary service along the Belgian coast up to Zeebrugge 🌎, under Lloyd’s Register class notation for an inland waterways tanker with estuary service up to a 2-m wave height 🌊, and cargo tanks designed for LNG at -165°C 💧.

Somtrans described United LNG I as an estuary-class LNG bunker barge carrying eight independent Type C cargo tanks of 1,000 m³ each 💧, with tank insulation noted as PUR foam and tank material as stainless steel grade 201LN ❄.

(C) Copyright Riviera Maritime Media 2025

Source: Somtrans

🔥 LNGAsFuel

MSC has taken delivery of another LNG dual-fuel containership from China’s Yangzijiang Shipbuilding 🎊.

MSC Saudi Arabia is the twelfth and last in a series of LNG dual-fuel containerships 💧 with a capacity of 16,000 teu.

This is another large containership built by Yangzijiang equipped with a wind deflector 🌪, which can reduce the wind resistance of the ship during sailing.

(C) Copyright LNG Prime 2025

Source: Yangzijiang Shipbuilding

🎬 LNGVideos

This is Baker Hughes LM9000 gas turbines to be supplied to Commonwealth LNG.

Baker Hughes received a contract from Technip Energies to supply primary liquefaction equipment for Commonwealth LNG's 9.5 million tonnes per annum export facility 🏭 under development in Cameron, Louisiana.

The award includes six refrigerant turbo compressors comprising LM9000 aeroderivative gas turbines 🚀 paired with centrifugal compressors. The scope also covers commissioning services, capital spares, extended warranty, and a full string test.

Source : Mustapha Zehhaf

👨💻 LNGJobs

LPG to LNG transition opportunities.

Clyde Marine Recruitment is looking for:

🎯 Fourth Engineers

Requirements

LNG or LPG Experience

Valid Advanced Gas Endorsement required.

High Voltage Management Certificate preferred

Have a great week ahead !

Mustapha 👋🏻

📺 LNGAds

Want to advertise in LNG4U? → Send your request to [email protected] 🤝

Read Next

Did You like this LNG4U Edition ?

If YES, please share it with your friends in Social Media to grow our LNGiers community