Welcome back to LNG4U — your pulse check on the LNG market.

We open with a perspective to keep you ahead 🎓, then spotlight the developments worth watching — from market signals 💰 to offshore activity 🚢.

Let’s dive in.

🎓 LNGKnowledge

The construction guidelines for LNG ships are found in 👉 "The International Code for the Construction and Equipment of Ships Carrying Liquefied Gases in Bulk", Commonly known as the IGC Code , which details the main design principles for Liquefied Gas Carriers 📊.

Source : Mdnautical

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

💰 LNGPrices

Freight rates / 174,000 m3 / 2 Stroke

Atlantic - (Spark30S) | $ 71,750 / day |

Pacific - (Spark25S) | $ 55,000 / day |

Natural Gas

Asia (JKM) - Feb 25 | $ 9.854 / mmBtu |

Europe (NWM) - Feb 25 | $ 9.398 / mmBtu |

Bunkers

$/MT | LNG | VLSFO | MGO |

Singapore | 632.00 | 430.00 | 625.50 |

Rotterdam | 646.10 | 420.00 | 613.50 |

🏭 LNGTerminals

A first cargo of US LNG has been received by Greece’s only floating storage and regasification unit, signalling the start of a new supply corridor 🥇 for imports to southern and eastern Europe.

The 174,000-cbm LNG carrier newbuilding Leshatt arriving at the 153,000-cbm FSRU Alexandroupolis (built 2010) in early December 🚢.

(C) Copyright Tradewinds 2026

Source: Melten

The U.S. in 2025 became the first country to export more than 100 million metric tons (mmt) of liquefied natural gas in a single year 🥇, powered by the startup of production from new plants.

The world’s largest LNG exporter sold 111 mmt of the fuel 💧, almost 20 mmt more than its nearest rival Qatar and nearly 23 mmt more than it did last year.

(C) Copyright Reuters 2026

Source: LNG Development

China received 22 shipments of liquefied natural gas (LNG) last year from two export projects in Russia sanctioned 🚨 by the United States and European Unio.

One shipment was from Portovaya and the rest were from the Arctic LNG 2 project 🏭

All of the shipments were delivered to the Beihai LNG Terminal in China's southwestern Guangxi region 📍.

Tanker name (IMO number) | Arrival date |

From Arctic LNG 2: | |

Arctic Mulan (9864837) | August 28 |

Voskhod (9953511) | September 6 |

Zarya (9953535) | September 9 |

Buran (9953509) | September 12 |

Iris (9953523) | September 16 |

Arctic Mulan (9864837) | September 22 |

Arctic Vostok (9216298) | September 30 |

La Perouse (9849887) | October 9 |

Arctic Metagaz (9243148) | October 14 |

Arctic Mulan (9864837) | October 17 |

Iris (9953523) | October 23 |

Arctic Vostok (9216298) | October 27 |

La Perouse (9849887) | October 30 |

Arctic Mulan (9864837) | November 11 |

Voskhod (9953511) | November 20 |

Arctic Pioneer (9256602) | November 22 |

Arctic Vostok (9216298) | November 26 |

Arctic Mulan (9864837) | December 4 |

Zarya (9953535) | December 11 |

Iris (9953523) | December 30 |

Arctic Mulan (9864837) | December 31 |

From Portovaya LNG: | |

Valera (9630004) | December 8 |

(C) Copyright OEDigital 2026

Source: Riviera

🏗 LNGShipbuilding

Capital Clean Energy Carriers (CCEC) has moved to further bulk up its LNG fleet, placing an order for three 3️⃣ newbuildings at HD Hyundai Samho in South Korea.

The en-bloc price for the trio stands at 💰769.5m. The ships will feature upgraded specifications and are designed to sit among the most fuel-efficient LNG carriers afloat 🌎, with lower fuel consumption and reduced boil-off rates compared with older tonnage.

One vessel due for delivery in the third quarter of 2028 and the remaining two scheduled for the first quarter of 2029 🎊.

(C) Copyright Splash247 2026

Source: CCEC

Shipbuilders see late surge in LNG carrier orders as year ends with more to come 📈

At least eight LNG carrier newbuildings 8️⃣ have been inked in the last few days, boosting the order total for 2025 to at least 34 vessels 📈.

Contracts for at least six or possibly more vessels are in the pipeline to be signed shortly 🤝, with discussions already underway for fresh orders in 2026.

(C) Copyright Tradewinds 2026

Source: Jerry Ridgeon

China’s DSIC Surpasses 2025 Targets, Marking Milestones in LNG Carriers, Smart VLCCs, and Global Ship Repair Market 🎊

During peak production periods, DSIC had as many as 63 vessels under construction simultaneously 📈.

This drives specialized production patterns across its bases: the Dalian base focuses on VLCCs, 110,000 DWT product tankers, and large LNG carriers 🚢

(C) Copyright IMarineNews 2026

Source: DSIC

Seapeak named as shipowner behind one of last LNG carrier orders of 2025 🎯

Seapeak is being linked to an order for two LNG carrier newbuildings worth 💰498.7m at Samsung Heavy Industries.

Newbuildings being connected to charters with upcoming floating LNG project 🏭

(C) Copyright Tradewinds 2026

Source: Samsung Heavy Industries

Heavy newbuilding and tightening climate rules point to a testing year for LNG shipping in 2026 🚢.

Massive liquefaction capacities expected by 2030 💧 will require a substantial increase in the LNG carrier fleet.

The fleet is already expanding faster than liquefaction capacity, with fleet growth of about 10% in 2025, with 89 LNG carriers joining the fleet, followed by 94 and 92 scheduled for delivery 🚀 in 2026 and 2027.

At mid-2025, the global fleet stood at 823 vessels against an orderbook of 343 ships 🏗, equivalent to 42% of the fleet.

(C) Copyright Riviera Maritime Media 2026

Source: Samsung Heavy Industries

Under the full escort of the Nantong Maritime Bureau’s patrol vessel and tugboats, the large floating liquefied natural gas facility “F450 FLNG,” 🚢 built by a company in Nantong, Jiangsu, was successfully launched and safely berthed at the outfitting dock 🎊.

This facility is Indonesia’s first and the world’s ninth FLNG project 9️⃣, marking a new high for Nantong’s offshore equipment manufacturing capabilities.

(C) Copyright Bit Get 2026

Source: itouchtv

🤝 LNGContracts

Egypt’s EGAS signed a Memorandum of Understanding (MoU) 🤝 with QatarEnergy for the supply of up to 24 LNG cargoes to be delivered in Ain Sokhna and Damietta ports ⚓ throughout the summer of 2026.

The MoU builds upon a strategic foundation laid during a May 2025 meeting in Doha, where Egypt and Qatar first discussed long-term contracts and infrastructure integration.

(C) Copyright Qatar News Agency 2026

Source: The Peninsula

💧 LNGBunkering

As more ships switch to liquefied natural gas as their primary fuel source, the Port of Nanaimo and Seaspan are stepping up 🤝 to meet the demand.

Seaspan operates three ships – the Seaspan Lions, Seaspan Garibaldi and Seaspan Baker – that carry out ship-to-ship LNG bunkering 💧 to vessels in Nanaimo, Vancouver and Long Beach, Calif.

LNG shore-to-ship and ship-to-ship bunkering is now a growing portion of the services the Port of Nanaimo 📍 provides for shipping, delivering cargo and anchoring in Nanaimo.

(C) Copyright PeaceArchNews 2026

Source: News Bulletin

China’s Nantong CIMC Sinopacific Offshore & Engineering has held a keel-laying ceremony 🏗 for Vitol’s 12,000-cbm liquefied natural gas (LNG) bunkering and supply vessel.

CIMC SOE will build for Vitol’s unit, Vitol International Shipping, one 1️⃣ 12,500-cbm and one 2️⃣ 20,000-cbm LNG bunkering vessel.

The company will take delivery of the vessels in the fourth quarter of 2026 and the third quarter of 2027 🎊.

(C) Copyright LNG Prime 2026

Source: CIMC SOE

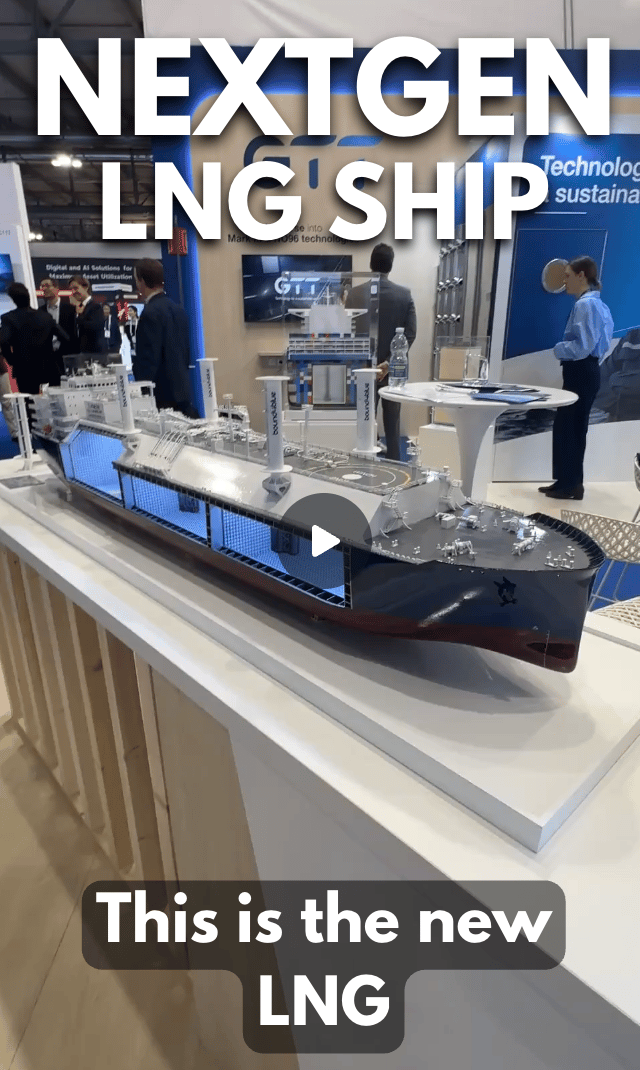

🎬 LNGVideos

This is the design for the first LNG ship featuring three tanks🥇

The switch from four tanks to three in a new LNG carrier design from GTT - Technology for a Sustainable World could reduce voyage-based emissions by up to 27% 📉.

The 200,000 cu m LNG design will trade at lower service speeds and will reduce unit freight costs by 5.5% from the outset 📉 , and by 14% by mid-century under regulatory frameworks including the EU Emissions Trading System (ETS) and FuelEU Maritime 📉.

Source : Mustapha Zehhaf

👨💻 LNGJobs

More LPG to LNG transition opportunitie.

Clyde Marine Recruitment is looking for:

🎯 Third Officers

Have a great week ahead !

Mustapha 👋🏻

📺 LNGAds

Want to advertise in LNG4U? → Send your request to [email protected] 🤝

Read Next

Did You like this LNG4U Edition ?

If YES, please share it with your friends in Social Media to grow our LNGiers community