Welcome back to LNG4U — your inside view on the trends steering the LNG market. We open with a key insight to keep you ahead 🎓, then break down the stories that matter — from market moves 💰 to offshore developments 🚢. Let’s get started.

🎓 LNGKnowledge

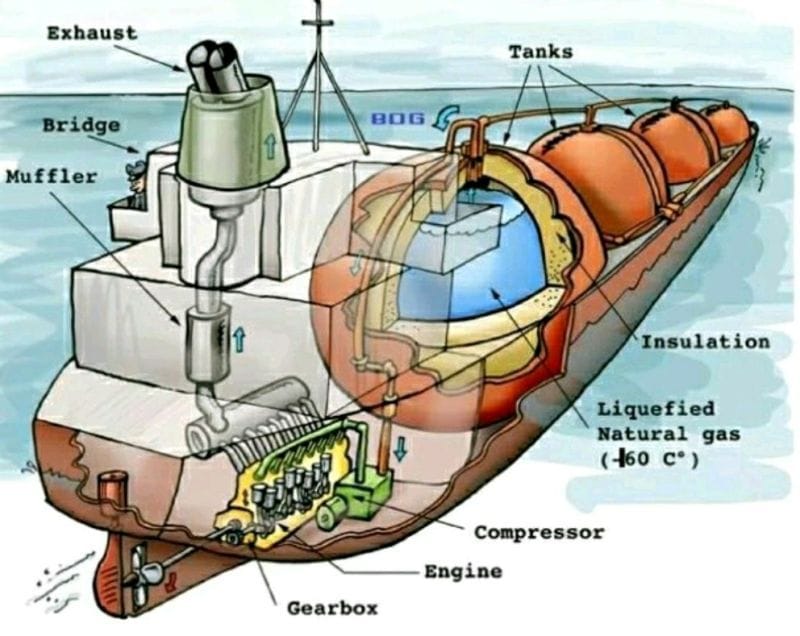

The LNG Ships, depending on the charter party, don't bunker Fuel Oil for months reducing 📉 anchorage time to half .

How❓

These ships use their cargo as fuel 🔥 for their Boilers or Engines, hence if the charterer/Buyer agrees, they go full gas consumption by either using the Natural NBOG or the Forced boil off FBOG generated from the LNG cargo 💧.

Source : ADI Analytics

The Future of the Content Economy

beehiiv started with newsletters. Now, they’re reimagining the entire content economy.

On November 13, beehiiv’s biggest updates ever are dropping at the Winter Release Event.

For the people shaping the next generation of content, community, and media, this is an event you won’t want to miss.

💰 LNGPrices

Freight rates / 174,000 m3 / 2 Stroke

Atlantic - (Spark30S) | $ 22,000 / day |

Pacific - (Spark25S) | $ 24,000 / day |

Natural Gas

Asia (JKM) - Nov 25 | $ 10.745 / mmBtu |

Europe (NWM) - Nov 25 | $ 10.064 / mmBtu |

Bunkers

$/MT | LNG | VLSFO | MGO |

Singapore | 667.94 | 459.00 | 672.50 |

Rotterdam | 672.51 | 430.00 | 655.00 |

🏭 LNGTerminals

Snam is buying the Higas land-based LNG terminal in Sardinia 🏭 and is planning to add a floating storage and regasification unit to develop the facility.

The Italian energy company has signed an agreement with the shareholders of Higas 🤝 to begin a period of exclusive assessment and negotiation regarding the potential acquisition of the share capital and the expansion and conversion of the current facility with an FSRU 🚢.

The terminal and storage facility is based in Oristano on Sardinia’s mid-west coastline to the north of Portovesme 📍.

(C) Copyright Tradewinds 2025

Source: Higas

State energy company Ecopetrol is set to kick off a process to develop a new floating regasification and storage unit-based LNG terminal 🚢 on Colombia’s northern coast.

The Covenas maritime terminal in Sucre department will use an FSRU, which Ecopetrol wants to have in operation by the end of this year 📅.

It is due to launch a formal process to secure regasification services within days 🏭.

(C) Copyright Tradewinds 2025

Source: Höegh Evi

Egyptian Natural Gas Holding Company (EGAS) has asked its LNG suppliers to delay 🕔 the delivery of at least 2️⃣0️⃣ cargoes that it had to receive by the end of the year, as Egypt struggles to anticipate actual gas demand 📊.

The cargoes, which have been planned to arrive in Egypt by the end of December 2025, will now be rescheduled for delivery during the first three months of 2026 📅.

The rescheduling of LNG imports suggests that Egypt is not in an immediate need of much imported gas by the end of the year as demand has dropped 📉 following the summer cooling demand peak.

The screenshot from Orbify, shows LNG vessels waiting North of Egypt for their berthing prospects ⚓

(C) Copyright Bloomberg 2025

Source: Orbify

A looming surge in liquefied natural gas supply 💧 through the end of the decade is poised to create demand that won’t go away

Prices of the super-chilled fuel are widely expected to drop 📉 as a number of LNG projects go online in the coming years, including ADNOC’s plant at Ruwais that will more than double the company’s export capacity 🚀.

(C) Copyright Bloomberg 2025

Source: AG&P

The German gas network agency announced that LNG imports by sea vessels reached their highest level 📊 since the opening of LNG reception terminals in 2022, reflecting significant changes in the German energy market ⚡.

The figures indicate that the amount of gas injected into LNG terminals during the first nine months of this year exceeded 📈 the total injected in 2023 and 2024 each separately.

(C) Copyright Tesaa world 2025

Source: Hanseatic Energy Hub

Bangladesh had planned an open tender for its third Floating Storage and Regasification Unit (FSRU) at Moheshkhali Island, Cox's Bazar 🚢. The initiative, however, has slowed, with the government now favouring a government-to-government (G2G) deal 🤝 over competitive bidding.

Petrobangla had been pursuing the development of the third FSRU after it scrapped the second Summit FSRU deal on 7 October last year ❌, citing the company's failure to submit the required performance bond within 90 days of signing the agreement.

The proposed FSRU is expected to have a regasification capacity of about 600 million cubic feet per day (mmcfd) 💭, aimed at meeting rising demand for imported liquefied natural gas (LNG) amid dwindling domestic gas reserves.

(C) Copyright TBS News 2025

Source: Excelerate Energy

🚢 LNGShips

Shipowners and brokers are reporting interest from charterers for LNG carriers to take on term business 📅 as they move to cash in on the weakened rate environment 💵.

Italian energy company Eni is understood to be looking to fix a vessel for a period of up to 1️⃣5️⃣ years.

(C) Copyright Tradewinds 2025

Source: GasLog

🏗 LNGShipbuilding

Italy’s Eni and Argentinian energy company YPF have taken the next step on a 12 million tonnes per annum 💧 phase of the Argentina LNG project which will use two huge floating LNG (FLNG) production units 🚢.

The project involves the production, processing, transportation, and liquefaction of gas for export through two FLNG units which will each have a capacity of 6 mtpa 💧.

(C) Copyright TradeWinds 2025

Source: Eni

🤝 LNGContracts

New agreements between Türkiye and the United States 🤝 in liquefied natural gas (LNG) and nuclear energy are set to strengthen their strategic energy partnership

BOTAŞ inked a long-term deal with a U.S. LNG exporter to supply about 4 billion cubic meters of American LNG 💧 annually starting in 2026.

The 20-year supply deal, starting in 2026, offers "win-win" benefits for supply security and economics 💵.

(C) Copyright Hurriyet daily news 2025

Source: Medium

Stabilis Solutions, Inc. disclosed a 10-year agreement 🤝 to supply Liquified Natural Gas for marine bunkering at the Port of Galveston and discussed the anticipated construction of an LNG liquefaction facility in Galveston, Texas 🏭.

The 10-year supply agreement ties Stabilis to sustained marine LNG demand at the Port of Galveston 💧, creating a multi-year revenue linkage if offtake and pricing terms are implemented as typical for bunkering contracts.

(C) Copyright Stock Titan 2025

Source: Port of Galveston

Venture Global's loss in a massive arbitration case with BP 🚨 is a black eye for the wider U.S. LNG industry, whose breakneck growth looks set to contribute to a global supply glut and far more headaches for investors.

The U.S. LNG producer, which has a $30 billion market cap, operates some of the largest U.S. LNG plants and was found to have breached 🔴 its supply obligations to BP

BP is seeking damages of more than 💰1 billion plus interest, costs, and attorneys' fees.

(C) Copyright Reuters 2025

Source: Finimize

💧 LNGBunkering

Molgas Energy Group has completed the full acquisition of Amsterdam-based Titan Energy Holding 🤝, parent company of Titan Clean Fuels, creating one of Europe’s largest integrated downstream LNG and bio-LNG players.

Titan, a well-known supplier of LNG and liquefied biomethane to shipping and industrial customers, operates a fleet of small-scale bunkering vessels serving Northwest Europe and other global markets 🌍.

With the addition of Titan, Molgas now runs seven 7️⃣ LNG bunkering vessels and manages a European network of over 70 road-fuelling stations and more than 200 sales points including partner outlets

(C) Copyright Splash247 2025

Source: Titan Clean Fuels

Italy’s floating regasification terminal operator OLT Offshore LNG Toscana has launched the first auctions 🎯 for a small scale liquefied natural gas (LNG) (SSLNG) service, achieved through a bidirectional LNG transfer at its floating storage and regasification unit (FSRU) moored off the coast of Livorno 📍.

These auctions are for product offering of 12 small scale slots of 7,500 liquid cubic meters 💧, distributed monthly from November 2025 to November 2026.

This service is expected to enable LNG to be loaded from the FSRU Toscana terminal 🚢 onto small LNG carriers that can refuel vessels powered by liquefied natural gas directly at sea or discharge the fuel at coastal storage facilities in major Mediterranean ports 🏭 .

(C) Copyright Offshore Energy 2025

Source: OLT Offshore LNG Toscana

Avenir LNG has signed a Time Charter Party (TCP) 🤝 with SeaRiver Maritime, the marine transportation affiliate of ExxonMobil Corporation, for Avenir’s second newbuild 20,000cbm LNG bunker vessel. The multi-year time charter commences in Q1 2027 📅

The ship features new Type C tank designs, lower boil off rates, the latest engine technologies, hull form optimisation, and subcoolers which offer carbon emission reductions 🌎 and minimize cargo losses compared to other vessels of this size 📉.

(C) Copyright Avenir LNG 2025

Source: Avenir LNG

Singapore-based Purus Marine has jumped into the LNG bunker vessel sector 💧 with a two-ship order contracted against time charters with energy major Shell 🤝.

The company has commissioned two 18,900-cbm LNGBVs at Chinese shipbuilder Nantong CIMC Sinopacific Offshore & Engineering 🏗.

(C) Copyright Tradewinds 2025

Source: Purus

⚡ AlternativeFuels

Mitsui O.S.K. Lines (MOL) has shaken hands 🤝 with two Australia-based companies, NH3 Clean Energy and Oceania Marine Energy, to embark on the two maritime players’ low-emission ammonia bunkering initiative 🔋.

The three partners signed a memorandum of understanding (MoU) regarding the development of clean ammonia bunkering operations in the Pilbara region of Western Australia 🌏.

(C) Copyright Offshore Energy 2025

Source : MOL

ABB has signed a term sheet agreement with Dutch renewable energy company SwitcH2 🤝 to engineer and supply automation and electrification solutions for SwitcH2’s floating production, storage and offloading (FPSO) unit 🚢 dedicated to producing green ammonia from green hydrogen 🔋.

The FPSO facility will be stationed off the coast of Portugal and powered by certified renewable electricity from the national grid under power purchase agreements ⚡. It will feature a 300 MW electrolyzer with the potential to produce up to 243,000 tonnes of green ammonia annually 💧.

(C) Copyright Offshore Energy 2025

Source : ABB

👨💻 LNGJobs

Globally recognized Shipping Major is looking for :

🎯 3rd Engineers

🎯 4th Engineers

Requirements

Minimum Sea Time: 1 year sea time in rank on LNG

Valid COC & STCWs

IAS & 2-stroke engine experience

Availability to start ASAP

Have a great week ahead !

Mustapha 👋🏻

Read Next

Did You like this LNG4U Edition ?

If YES, please share it with your friends in Social Media to grow our LNGiers community

📺 LNGAds

Want to advertise in LNG4U? → Send your request to [email protected] 🤝