Welcome back to LNG4U — your briefing on the forces shaping the LNG market. We open with a perspective to help you stay ahead 🎓, then turn to the developments worth watching — from market signals 💰 to offshore activity 🚢. Let’s dive in.

🎓 LNGKnowledge

Some LNG ships have a Reliquefaction plant onboard to reliquify 💧 the natural boil off NBOG and return it to the cargo tanks instead of burn it 🔥 in their engines.

The principles of heat transfer, evaporation and condensation are applied in refrigeration systems. The below figure 👇 shows the operating cycle of simple shipboard refrigeration cycle on a fully refrigerated LPG carrier. While we will learn the basics of refrigeration on an LPG system, this will help build your understanding 📈for #LNG reliquefaction systems.

In a single stage compression reliquefaction cycle the boil-off vapours from the cargo tank are drawn off by the compressor and compressed. This compression process increases 📈 the pressure and temperature of the vapour, allowing it to be condensed against seawater in the condenser. The condensed liquid 💧is then flashed back to the tank via float expansion valve or a level control. The liquid/vapour mixture that is returned to the cargo tank is normally distributed by a spray rail to maximise the cooling effect within the tank.

Source : LNG Shipping Knowledge

The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

💰 LNGPrices

Freight rates / 174,000 m3 / 2 Stroke

Atlantic - (Spark30S) | $ 92,000 / day |

Pacific - (Spark25S) | $ 75,750 / day |

Natural Gas

Asia (JKM) - Feb 25 | $ 9.551 / mmBtu |

Europe (NWM) - Feb 25 | $ 8.906 / mmBtu |

Bunkers

$/MT | LNG | VLSFO | MGO |

Singapore | 631.85 | 426.50 | 615.00 |

Rotterdam | 625.35 | 396.00 | 602.00 |

🏭 LNGTerminals

Russia has, for the first time, deployed its entire fleet of eight nuclear-powered icebreakers simultaneously 🚨 to maintain winter shipping lanes in the Gulf of Ob and the Yenisei Gulf 📍.

The unprecedented deployment is focused on ensuring the flow of oil, liquefied natural gas (LNG) 💧, and mineral cargoes from Russia’s Arctic production regions, including the Arctic Gate oil terminal, Yamal LNG, and Norilsk Nickel 🏭.

(C) Copyright GCAPTAIN 2025

Source: Atomflot

The U.S. Office of Fossil Energy and Carbon Management has received an application 📕 from ST LNG for a long-term, multi-contract authorization to export domestically produced liquefied natural gas (LNG) 💧 up to the equivalent of 460 billion cubic feet of natural gas per year.

The proposal entails the export of LNG from its proposed deepwater port export terminal, the ST LNG DWP development project, to be situated in the Brazos Block BA-476 off the southeast coast of Matagorda, Texas 📍.

(C) Copyright Offshore energy 2025

Source: ST LNG

US interest in importing LNG via Greece has fired up existing plans to site a second 2️⃣ floating storage and regasification unit in one of the country’s ports.

Four projects are now vying 🚀 for contention to put a second FSRU in place.

Motor Oil-controlled Dioriga Gas wants to install a 2.5bn-cbm per year FSRU near Corinth 🚢, for which it is seeking €179m ($210.5m) in funds from the European Union.

(C) Copyright Tradewinds 2025

Source: Gastrade

Energy Transfer is suspending development of the Lake Charles LNG project 🚫 in order to focus on allocating capital to its significant backlog of natural gas pipeline infrastructure projects 💵 that Energy Transfer believes provides superior risk/return profiles 📈.

Energy Transfer management has determined that its continued development of the project is not warranted by Energy Transfer but remains open to discussions with third parties 🤝 who may have an interest in developing the project.

(C) Copyright LNG Industry 2025

Source: Energy Transfer

🚢 LNGShips

LNG tanker Kunpeng has loaded a cargo from Russia's Portovaya LNG plant that is under Western sanctions 🚨

The 138,306-cbm membrane-type Kunpeng was named SK Sunrise in the past (built 2003) 🚢 and was belonging to the South Korean owner SK Shipping before she was sold last March.

This is the first time that the Kunpeng, which is not under sanctions ❗, has picked up an LNG cargo from a designated project. Until last year, the Kunpeng mostly delivered LNG to South Korea from Qatar and Australia 🌏.

The tanker's registered owner and its ship or commercial manager as Reveka Marine Ltd 🏢, with a registered address in the Marshall Islands.

(C) Copyright Reuters 2025

Source: MarineTraffic

Malaysian shipowner MISC Group is selling three of its laid-up steam turbine-driven LNG carriers 🚢 as it renews its fleet with more modern tonnage.

MISC is inviting expressions of interest in the 137,100-cbm 1️⃣ Puteri Firus Satu and 2️⃣ Puteri Zamrud Satu (both built 2004), along with the 137,595-cbm 3️⃣ Puteri Mutiara Satu (built 2005).

The company appears to be offering the membrane-type ships for sale either as trading assets or demolition candidates 🏗.

(C) Copyright Tradewinds 2025

Source: MISC

These are the final days of an LNG ship at the breaking yard 🏗.

This LNG ship has arrived to the scrap yard last September and her bow’s already gone 📉

Source: Eren Topcu

🏗 LNGShipbuilding

The global shipbuilding orderbook has climbed to its highest level in 15 years 🚀 following consecutive periods of intense contracting.

Between January and November 2025, newbuilding deliveries reached 70M gt 🚢, representing a year-on-year increase of approximately 7% 📈.

In the LNG carrier segment, an orderbook of 51M m³, representing approximately 39% of the active fleet. This marks a decline 📉 from 52% recorded in the same period of 2024.

(C) Copyright Riviera Maritime Media 2025

Source: gcaptain

Norway’s Knutsen OAS Shipping is being named as the company behind an order for seven 7️⃣ LNG carriers worth 💰1.8bn at South Korean shipbuilder Hanwha Ocean, which will be delivered by 30 June 2029 🎊.

Shipowner nets business from Edison and Equinor 🤝 but has it also won Eni’s tender?

(C) Copyright Tradewinds 2025

Source: Knutsen OAS

COSCO SHIPPING celebrated the delivery ceremony of OCEAN OASIS to her charterer Sinochem International Corporation 🎊

Ocean Oasis is equipped with GTT - Technology for a Sustainable World NO96 L03+ containment system

(C) Copyright Adnan Ezzarhouni 2025

Source: Adnan Ezzarhouni

Another order for the three tanks LNG design 🥇, after BW LNG, now NYK is moving forward with this design.

Japan’s Nippon Yusen Kaisha (NYK) is pushing ahead with another LNG carrier expansion, lining up four 4️⃣ large newbuildings at HD Hyundai Heavy Industries.

The Tokyo-headquartered behemoth has signed up for a 200,000 cu m 💧 quartet at the Korean yard, with options in place for a further four 4️⃣ units.

The deal is tied to a co-investment with Norwegian shipleasing specialist Ocean Yield 🤝, which confirmed it will take around a 50% ownership stake alongside NYK in the four ships. Deliveries are slated for 2028 and 2029 🎊.

(C) Copyright Splash247 2025

Source: Mustapha Zehhaf

GTT has secured an order from HD Korea Shipbuilding & Offshore Engineering (HD KSOE) 🤝 for the tank design of a new liquefied natural gas (LNG) carrier.

The LNG carrier will be built by the shipyard Hyundai Samho Heavy Industries (HSHI) on behalf of the ship-owner Hyundai Glovis 🚢.

With a total capacity of 174,000 m3, the vessel’s cryogenic tanks will be fitted with the Mark III Flex membrane containment system 🏢

Delivery of the vessel is scheduled for the fourth quarter of 2028 🎊.

(C) Copyright Marine Link 2025

Source: GTT

🤝 LNGContracts

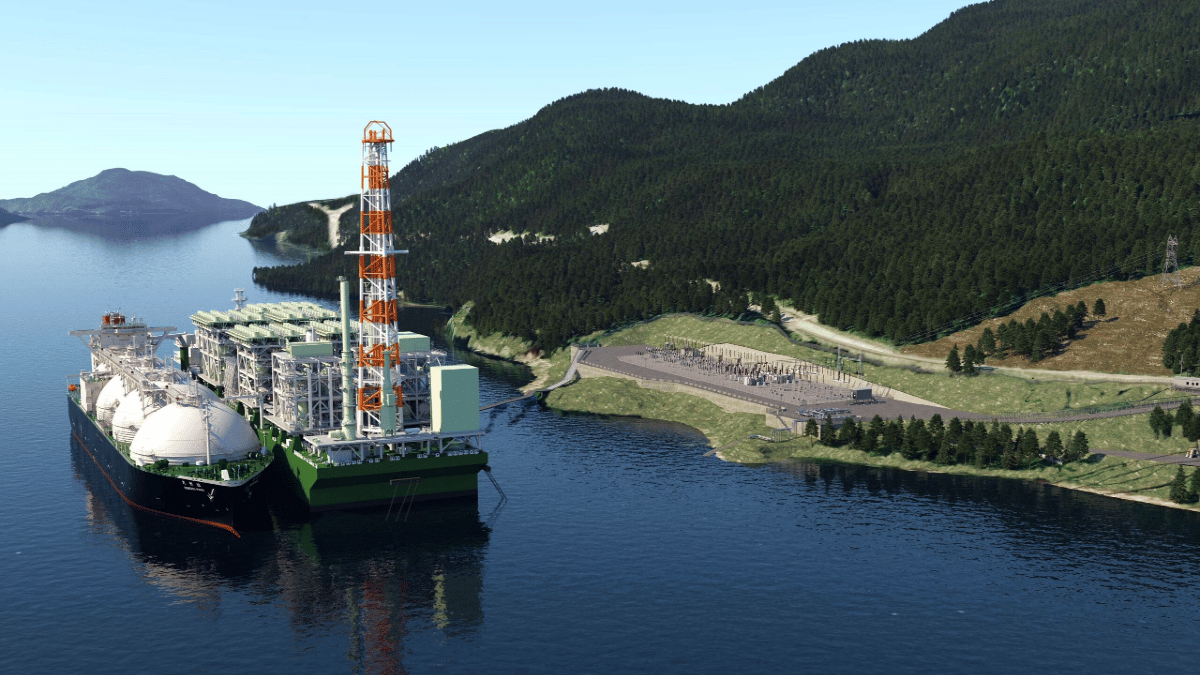

Ovintiv and Pembina Pipeline enter into agreement for Cedar LNG capacity 🤝.

The agreement enables the export of 0.5 million tpy of LNG 💧, under which Pembina will provide transportation and liquefaction capacity to Ovintiv over a 12-year term 📅, commencing with commercial operations at Cedar LNG, anticipated in late 2028.

(C) Copyright LNGIndustry 2025

Source: Cedar LNG

Hungary has signed a five-year contract with U.S. energy giant Chevron to buy 400 million cubic meters of liquefied natural gas (LNG) 💧 from the US per year over 5 years.

Hungary’s interest is to buy energy from as many sources and routes as possible, at the best prices 💵, to protect the economy and keep household energy bills among the lowest in Europe.

(C) Copyright Nampa 2025

Source: Nampa LNG

Japan’s power generation major JERA has won a long-term liquefied natural gas (LNG) supply agreement with 🤝 Hokkaido Gas.

Thanks to a seven-year sale and purchase agreement (SPA) with Hokkaido Gas, JERA will supply two to three LNG cargoes per year, equivalent to approximately 130,000 to 200,000 metric tonnes annually 💧, on a delivered ex-ship (DES) basis from its extensive global LNG portfolio, beginning in 2027 🚢.

(C) Copyright Offshore Energy 2025

Source: JERA

💧 LNGBunkering

Stabilis Solutions entered into a time charter agreement with 🤝 Seaspan ULC for the time charter of a liquified natural gas bunkering vessel Seaspan Gribaldi 🚢.

Stabilis will pay the Owners 💰32,400 per day for two years for the time charter of the Garibaldi.

Delivery date of the Garibaldi to the Company and the time charter commencement date are expected to be on or about March 1, 2026 📅, in Galveston, Texas

The Agreement provides an option for Stabilis to purchase the Garibaldi for 💰60 million during the term of the time charter.

(C) Copyright Street Insider 2025

Source: Seaspan ULC

Carnival Corp signed an LNG offtake agreement with 🤝 Stabilis Solutions to take volumes from a planned liquefaction facility at Port of Galveston 💧.

The volumes will be delivered by a proposed Jones Act-compliant bunkering vessel 🚢 and will begin in the fourth quarter of 2027, subject to the financing and construction of the facility, along with other conditions.

(C) Copyright Seatrade Cruise 2025

Source: DNV

🔥 LNGAsFuel

Wan Hai Lines has signed contracts for six 6️⃣ LNG dual-fuel-ready containerships of about 6,000 TEU in a transaction valued at 💰492.0m

The filing puts the price at 💰75.2m per vessel and says the consideration includes “vessel upgrade equipment”.

The ships will be built at CSSC Huangpu Wenchong in China and that deliveries are expected by 2030 🎊.

(C) Copyright Port News 2025

Source: Wan Hai Lines

🎬 LNGVideos

In this video, I take you to Arzew, the birthplace of the global LNG trade — the port from which the world’s first commercial LNG cargo was shipped to the UK.

You’ll see the exact berth where Methane Princess was alongside in 1964, marking the beginning of LNG shipping and the industry we know today.

Source : Mustapha Zehhaf

👨💻 LNGJobs

ADNOC Logistics and Services is looking for :

🎯 Chief Engineers x 2

Have a great week ahead !

Mustapha 👋🏻

📺 LNGAds

Want to advertise in LNG4U? → Send your request to [email protected] 🤝

Read Next

Did You like this LNG4U Edition ?

If YES, please share it with your friends in Social Media to grow our LNGiers community