Welcome back to LNG4U — your go-to brief on what’s driving the LNG market.

We start with a sharp insight to keep you ahead of the game 🎓, then break down the headlines that matter — from market moves 💰 to offshore developments 🚢.

Quick, clear, and made for decision-makers. Let’s jump in.

🎓 LNGKnowledge

What are the process steps that the Natural Gas passes through from the underground well to the LNG ship's tanks as liquid ❓

The Raw feed gas from the underground well is sent to the liquefaction plant 💧 :

1️⃣ Condensate removal - It is first stripped of condensates.

2️⃣ Acid gas and Mercury removal - It is then followed by the removal of acides gases Carbon dioxide CO² and Hydrogen sulphide H²S. Carbon dioxide must be removed as it freezes ❄ at a temperature above the atmospheric boiling point of LNG 👉-60°C and the toxic compound hydrogen sulphide is removed as it causes 👉 atmospheric pollution when being burnt 🔥 is a fuel.

3️⃣ Dehydration - Acid gas removal saturates the gas stream with water vapour 💭 and this is then removed by the dehydration unit.

4️⃣ Fractionation - The gas then passes to a fractionating unit where the 👉 NGLs are removed and further split into Propane and Butane.

5️⃣ Liquefaction - Finally, the main gas flow, now mostly Methane, is liquefied 💧 into the end product Liquefied Natural Gas LNG and stored in tanks 🏢 ready to be loaded into LNG ships.

Source : McGuire & White

💰 LNGPrices

Freight rates / 174,000 m3 / 2 Stroke

Atlantic - (Spark30S) | $ 33,750 / day |

Pacific - (Spark25S) | $ 38,250 / day |

Natural Gas

Asia (JKM) - Sep 25 | $ 12.147 / mmBtu |

Europe (NWM) - Sep 25 | $ 11.127 / mmBtu |

Bunkers

$/MT | LNG | VLSFO | MGO |

Singapore | 735.64 | 516.00 | 692.00 |

Rotterdam | 719.31 | 506.00 | 713.50 |

🏭 LNGTerminals

Belgian energy infrastructure company Fluxys has hired Madrid-headquartered Sacyr Proyecta 🤝 to take care of front-end engineering design (FEED) services 🏗 related to the development of a CO2 emissions reduction project 💭 at its liquified natural gas (LNG) terminal in Zeebrugge, Belgium 📍.

This contract, which builds upon over 15 years of collaboration between the two companies 📅, is part of Fluxys’ program to achieve net zero from its own operations 📉, as the new project aims to curb CO2 emissions while maintaining the send-out capacity at the Zeebrugge regasification terminal 📈, where ConocoPhillips recently disclosed a capacity booking, allowing it to import and regasify 0.75 million tonnes per year (mtpa) of LNG 💧 for delivery in Belgium and throughout Europe, starting in April 2027 📅.

(C) Copyright Offshore Energy 2025

Source: Sacyr Proyecta

The Philippines is on track for an annual decline in coal-fired electricity output 📉 for the first time in nearly two decades, driven by rising liquefied natural gas-fired power generation 🔥.

The Philippines has the most coal-dependent grid in Southeast Asia but its electricity tariffs, which are not subsidised, are the second highest 💵 in the region behind Singapore.

The archipelago's liberalised market enables power retailers to pivot to LNG 💧, unlike in Indonesia and Malaysia, where cheap coal keeps subsidies manageable.

LNG is expected to meet a rising share of the Philippines' projected 5% annual growth in power demand over the next decade 📈 as coal-fired power output is set to peak in 2030 due to a moratorium on new coal capacity construction.

(C) Copyright Reuters 2025

Source: AG&P

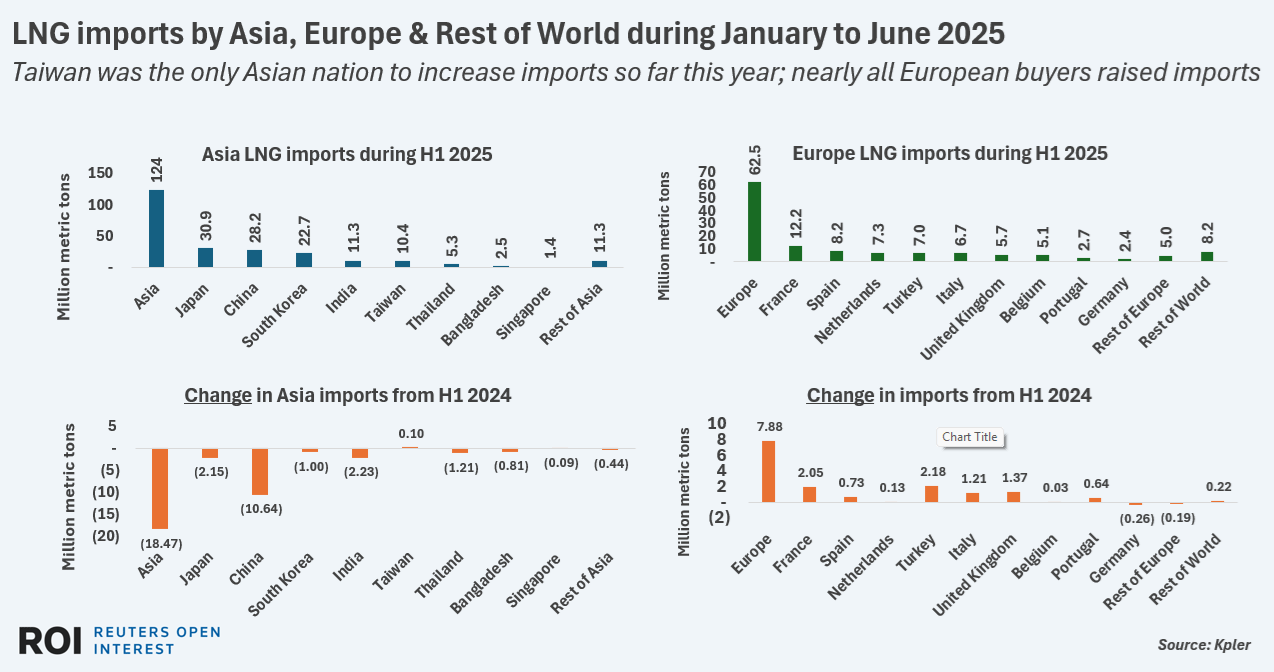

Imports of LNG into Asia have contracted by a record amount during the first half of 2025 🏆, as slowing economic growth and trade tensions with the United States cooled demand for the super-chilled fuel 💧.

The only exception in Asia so far in 2025 has been Taiwan 🛑, which luckily for liquefied natural gas exporters is primed to substantially lift its gas dependence following the closure ❌ of its last remaining nuclear reactor last month.

(C) Copyright Reuters 2025

Source: Kpler

🚢 LNGShips

An LNG carrier blacklisted by the US has become the second gas vessel 2️⃣ to dock at Russia's sanctioned Arctic LNG 2 plant 📍.

The 174,000-cbm Voskhod (built 2023) arrived at the facility in ballast on Wednesday 📅.

(C) Copyright Tradewinds 2025

Source: Marine Traffic

Energos Infrastructure has got hold of a multi-year deal for one of its floating storage and regasification units (FSRUs) 🚢, which will be deployed at a liquefied natural gas (LNG) import terminal in Egypt 📍.

The five-year charter will enable the 138,250-cubic-meter (cbm) FSRU 👉 Energos Winter to work for the Egyptian Natural Gas Holding Company (EGAS) at the LNG import terminal in Damietta, Egypt 📍. The 2004-built unit will join the FSRU Energos Eskimo in the Middle Eastern country as early as August 2025 📅.

(C) Copyright Offshore Energy 2025

Source: Energos Infrastructure

The European Union has delisted three previously sanctioned Mitsui O.S.K. Lines (MOL) LNG carriers 🤝. The move comes as part of the EU’s 18th package of economic sanctions against Russia, which imposed measures against 105 additional shadow fleet vessels 🚨.

The newbuilding LNG carriers 1️⃣ North Moon, 2️⃣ North Ocean, and 3️⃣ North Light controlled by MOL were included in the 17th package two months earlier ❌.

(C) Copyright GCAPTAIN 2025

Source: J. Ripmeester

🏗 LNGShipbuilding

Hanwha Shipping ordered a liquefied natural gas (LNG) carrier 🚢 from Hanwha Philly Shipyard, marking the first U.S.-ordered, export-market-viable LNG carrier in almost 50 years 🥇.

This order, which includes an option for an additional vessel, represents a significant milestone in America’s shipbuilding and maritime resurgence.

The vessel will cost “at least 💰250 million” and have a capacity of 174,000 cubic meters. It will be equipped with a GTT containment system and an M-type, electronically controlled, gas injection (MEGI) engine 🏭.

(C) Copyright GCAPTAIN 2025

Source: Hanwha Ocean

🤝 LNGContracts

The Switzerland-based trader and shipowner VITOL said charterer GAIL (India) has signed up to a 10-year deal 🤝 to purchase 1m tonnes each year 💧, beginning in 2026.

That equates to about 139 cargoes on a 170,000-cbm LNG carrier 💧.

(C) Copyright TradeWinds 2025

Source: Vitol

Italy’s oil and gas giant Eni has executed a liquefied natural gas (LNG) sales and purchase agreement (SPA) 🤝 with U.S. energy player Venture Global.

Under the deal, Eni will purchase 2 million tonnes per annum (mtpa) of LNG 💧 for 20 years from CP2 LNG Phase 1, which is Venture Global’s third LNG project. The offtake is slated to start by the end of the decade 📅.

(C) Copyright Offshore Energy 2025

Source: Venture Global

With Vietnam’s dynamic development and electricity demand projected to continue rising sharply 📈, Karpowership has identified Vietnam as its top priority market in Asia 🎯.

Karpowership emphasized their desire to build a long-term, sustainable partnership with EVN 🤝, ensuring mutual benefits for the company, the power sector, and the Vietnamese people ⚡.

EVN and Karpowership agreed to maintain information exchange 📊, jointly research and assess actual conditions as a basis for considering potential cooperation in the future.

(C) Copyright EVN 2025

Source: Nikkei

🔥 LNGAsFuel

Japan’s ‘largest cruise ship ever’ 🥇, the liquefied natural gas (LNG)-powered ASUKA III, has officially been named at its home port of Yokohama 🎊.

The newbuild was bunkered with liquefied natural gas 💧 at the Chuo Wharf in Hakata port. The operation was performed by the KEYS Azalea 🚢, Japan’s inaugural dual-fuel LNG bunkering vessel owned and operated by Fukuoka-headquartered KEYS Bunkering West Japan Ltd. (KEYS).

(C) Copyright Offshore Energy 2025

Source: NYK Line

LNG as a fuel is on the rise📈, but the infrastructure to provide it is not 📉.

A major disconnect between demand for LNG bunkers and the means of delivering is unavoidable in 2026 🚨 and could persist for years if something is not done.

(C) Copyright TradeWinds 2025

Source: Seaspan Energy

Taiwanese container shipping firm Yang Ming Marine Transport has approved the order of seven 7️⃣ 15,000 twenty-foot equivalent unit (TEU) LNG dual-fuel container ships 💧 from South Korea's Hanwha Ocean 🏗.

The new vessels are scheduled for delivery in 2028-29 and will replace the aging vessels in Yang Ming's fleet 🎊.

The adoption of dual-fuel solutions for the 15,000 TEU vessels, alongside the five LNG dual-fuel container ships scheduled for delivery from 2026, will advance the firm's strategic development towards reducing greenhouse gas (GHG) emissions 📉while ensuring stable services on East-West shipping routes.

(C) Copyright Argus Media 2025

Source: Hasenpusch

Ship orders for new alternative-fuelled vessels fell to 151 📉 in the first half of 2025 compared with 179 a year earlier.

These orders represented 19.8mn gross tonnes, up by 78pc from the same period in 2024 🚢.

LNG-fuelled vessels accounted for 87 of the new orders in the first half, followed by 40 methanol-fuelled ships, 17 LPG-powered vessels, and four hydrogen and three ammonia-fuelled ships.

(C) Copyright Argus Media 2025

Source: DNV

⚡ AlternativeFuels

World’s first oceangoing ammonia-powered gas carrier 🥇, currently under construction at HD Hyundai Mipo shipyard in South Korea, has been fitted with an ammonia two-stroke engine 🏭 developed by Swiss marine power company WinGD.

WinGD has delivered and installed its X52DF-A engine on the 46,000 cubic meter (cbm) LPG/ammonia carrier 💧 being built for Belgian shipping company EXMAR.

Once constructed, the vessel will be the first ammonia-fueled gas carrier in service 🥇, and the engine will be one of the first WinGD’s ammonia-fueled X-DF-A designs to enter commercial operation 🥇.

(C) Copyright Offshore Energy 2025

Source : WinGD

🎬 LNGVideos

Cameron LNG announced the export of its 1,000th cargo of liquefied natural gas 🎊, loaded aboard the Maran Gas Kimolos.

In six years of commercial operations, they shipped LNG from its terminal in Hackberry, Louisiana to 37 countries 🌎, helping to meet growing global demand for secure and sustainable energy with a commitment to operational excellence and reliability.

(C) Copyright Cameron LNG 2025

Source : Cameron LNG

👨💻 LNGJobs

Have a great week ahead !

Mustapha 👋🏻

Read Next

Did You like this LNG4U Edition ?

If YES, please share it with your friends in Social Media to grow our LNGiers community

📺 LNGAds

Want to advertise in LNG4U? → Send your request to [email protected] 🤝